The global health and wellness market continues to climb.

Both DTC and service-based businesses have experienced supercharged growth in recent years. Both newer brands and fan favorites have been able to take advantage of soaring interest in virtual and physical classes, personalized wellness experiences, and smart fitness equipment.

But increasing interest means greater competition. Wellness services and products are everywhere. How can your DTC ecommerce brand stand out from the noise?

Here we’ll share global insights, stats, and trends on what 2023 will likely bring to the industry. First though, we’ll review the state of the industry and what’s been shaking it up in 2022.

The health and wellness market: key trends and stats

Since the beginning of the COVID-19 pandemic, the global health and wellness market has soared. Stay-at-home orders and constant reminders about health meant that people began to prioritize wellness.

In aMcKinsey surveyof roughly 7,500 consumers in six countries, 79% of the respondents said they believe that wellness is important, and 42% consider it a top priority. In fact, consumers in every market reported a substantial increase in the prioritization of wellness over the past two to three years.

That prioritization of health has supercharged growth in the industry––growth that looks set to continue in the future. In 2022, the global wellness market is projected to hit$5.59 trillion. By 2025, it’s expected to reach nearly $7 trillion––a 25% increase.

Health and wellness is a large industry that includes multiple sub-categories. Some of these categories include:

- Fitness

- Mental health

- Nutrition

- Immune health

- Sleep

- Physical health

- Appearance

- Mindfulness

- Women’s health

As consumer interest climbs and purchasing power increases, there are huge opportunities for brands. This is at a time whenspending on personal wellness is reboundingafter stagnating or declining during the COVID-19 pandemic.

In overall health and wellness spending, consumers anticipate spending more on both wellness products and services in the next year. Currently, products account for around70% of wellness spending, and services for around 30%.

One leading product segment is the global vitamins, minerals, and supplements market––it’s expected to grow from$129 billion in 2021 to $196 billion by 2028.

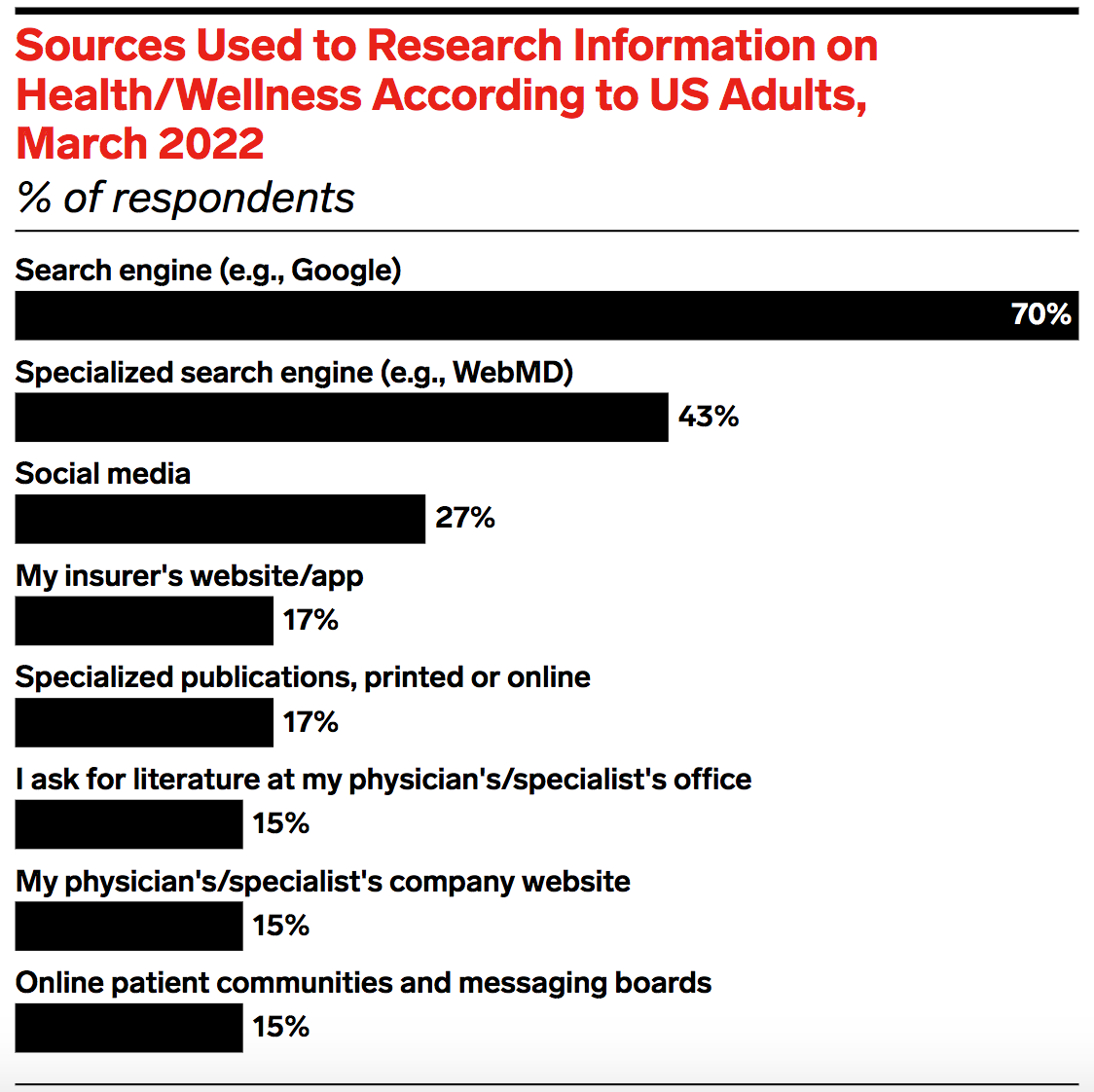

Virtual wellness is also a growing segment as increasing numbers of consumers use their smartphones to participate in wellness experiences and access health information. Currently,70% of US adultssay they use a search engine such as Google to research information on health and wellness.

Consumers also look to social media and online communities for relevant health information.

But as the popularity of wellness increases, the landscape is becoming increasingly crowded––brands need to be strategic about how and what they create.

Health and wellness activities are no longer limited to physical experiences. To stand out, brands must build online and omnichannel experiences.

So how will the health and wellness industry shape up in 2023 and beyond?

Susie Ellis, chair and CEO of theGlobal Wellness Summit, explains how the pandemic has irreversibly shifted how people view and respond to wellness.

“If it’s always daunting to predict trends in the fast-moving wellness space, it’s especially so two years into a pandemic, where the long-promised ‘post-pandemic world’ is becoming visible but is repeatedly delayed,” she says. “One thing that this forecast makes clear is that the future of wellness will be anything but a ‘restart’ of 2019. What consumers now need most, what they perceive as ‘true wellness,’ has profoundly changed.”

To future proof your business, tap into the health and wellness trends that make sense for your brand and its target audience.

In thedirect-to-consumer (DTC)health and wellness world, some trends to watch include:

- Brands partnering with authentic influencers

- DTC brands offering wellness services in conjunction with products

- Consumers purchasing more smart goods

- Fitness fanatics taking augmented reality fitness classes

- Men’s personal care products growing in popularity

The future of health and wellness in 2023 and beyond: 8 trends to follow

Personalized wellness experiences

People expect personalized health and wellness. But consumers are also increasingly privacy-conscious––they’re wary of who they share their personal data with.Fifty-six percentof consumers says they don’t trust tech companies with their health information.

To build consumer trust, health and wellness brands must provide value to consumers who are comfortable exchanging privacy forpersonalization. In practice, this looks like wellness brands going beyond building personalized marketing campaigns and building tailor-made product offerings unique to the consumer.

According to a recent study led byVesta, 58% of consumers are “very interested” in personalized supplements made just for them, with younger generations like Gen Z and millennials being most interested (71%).

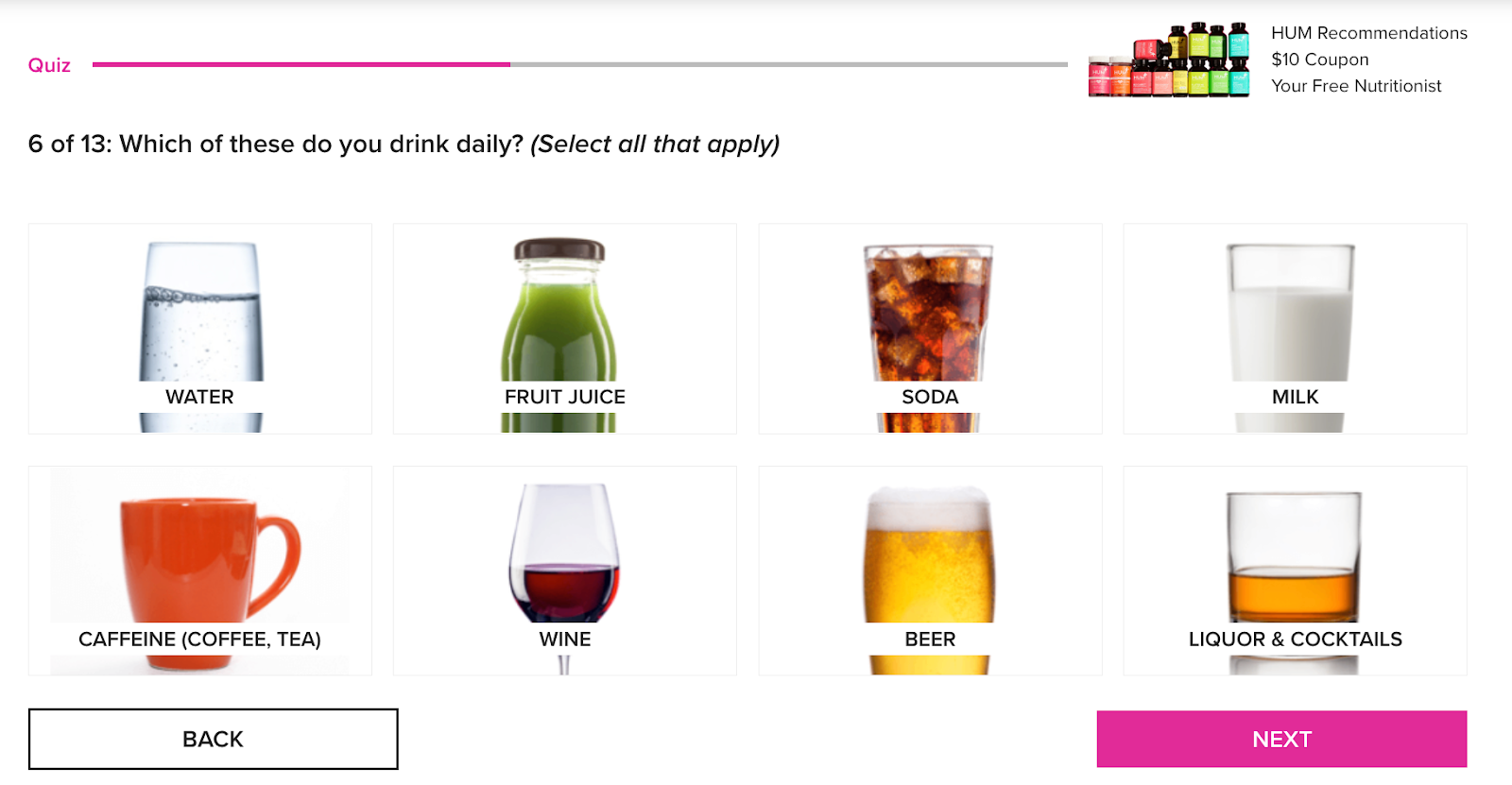

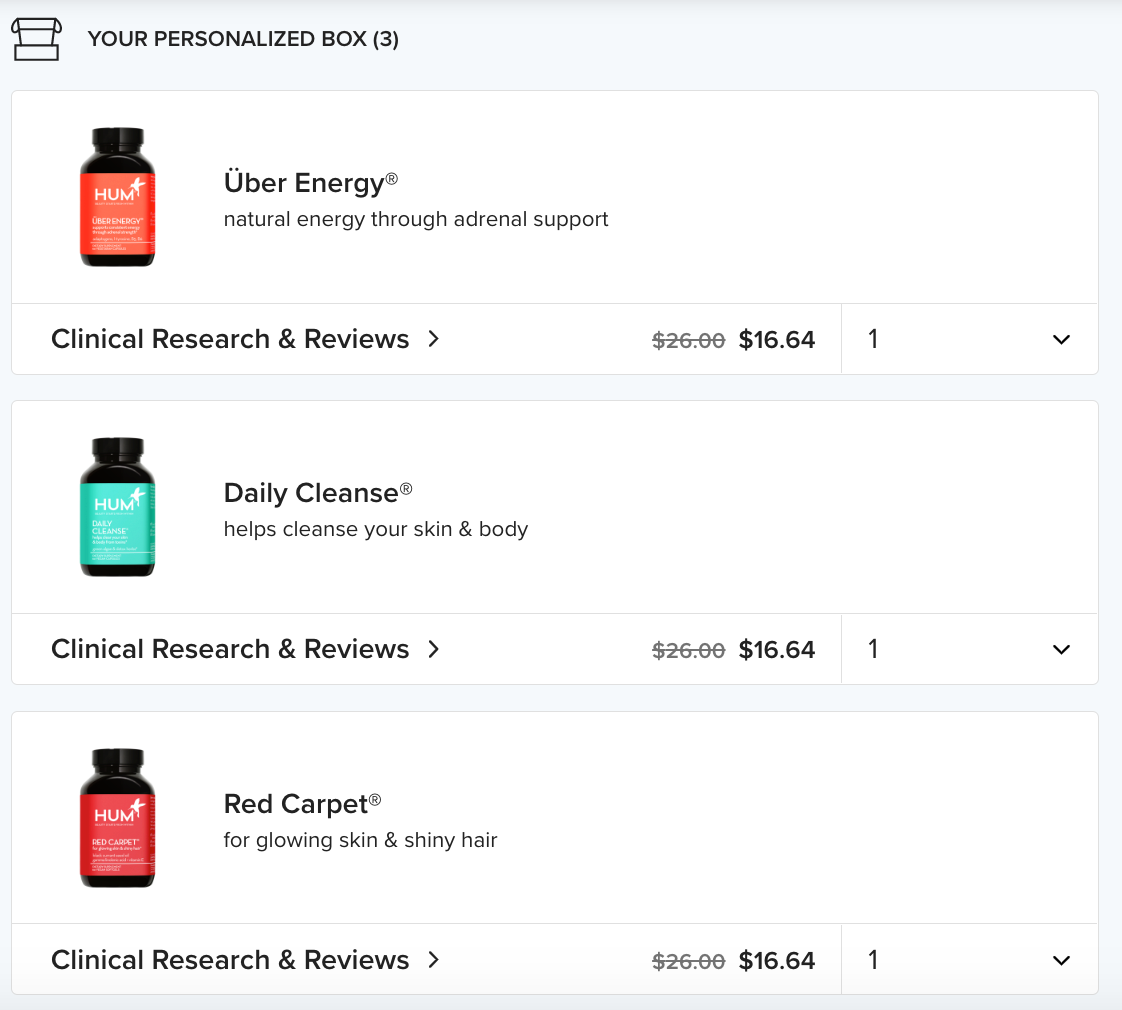

Supplement brandHUM Nutritionpersonalizes its offering to each individual consumer. Customers complete a quick 13-question quiz about their daily lifestyle, food, and exercise habits.

Based on the consumer’s unique combination of responses, HUM Nutrition shares personalized supplement recommendations. The aim is to share supplements with real health benefits to boost the consumer’s immune system, mental wellness, and broader wellbeing.

Then, in exchange for the customer’spersonal data, including their email address, HUM provides a 50% discount on their first order.

Susan Frech, CEO ofVesta, explains that personalized health and wellness offerings are often the key to standing out from competitors and building consumer health routines that last beyond the new-year excitement.

“Becoming healthier during the pandemic was not a flash in the pan, but a shift in priorities, and many are turning to digital neighbors for recommendations,” she says.

“Whether you’re a legacy or challenger brand, now is the time to offer personalized products and experiences that secure strong relationships and create a pipeline of advocacy that lasts beyond the ‘New Year, New You’ season of 2023.”

Brands will partner with authentic influencers

Influencers are a central part of the health and wellness industry. In the US, Europe, and Japan,10% to 15% of consumerssay they follow social media influencers and that they have already made a purchase based on an influencer’s recommendation.

But it’s no longer about collaborating with the influencer or celebrity that has the highest follower count. Instead, people want to see authentic content from relatable influencers. For wellness brands, this may mean partnering with micro-influencers (10,000 to 100,000 followers) or even nano-influencers (less than 10,000 followers).

Brands often see that influencers with fewer followers create more authentic content when compared to overly polished celebrity endorsements. And an important part of any influencer marketing strategy is building trust with its audience––people are much more likely to trust accounts they can more easily relate to.

In fact, Lauchmetrics found that these influencers with lower follower counts made up the mostMedia Impact Value (MIV), a metric for measuring media placement impact across the board.

For instance, supplement brand,Total Life Changesshares authentic posts created by micro-influencers with its audience. Each post includes a brief product review.

Shopify merchant HiSmileis another example of a wellness brand that used aninfluencer-led marketing strategyto get its products in front of a broad global target audience on Instagram. Social selling and influencer marketing drove HiSmile from a kitchen table idea to a global force.

For instance, its Instagram campaign with Conor McGregor alone scored afive times return on ad spend爱尔兰战士冥界,受欢迎ping HiSmile reach a whopping 14 million 18- to 24-year-olds in its campaign—plus an additional 90% increase in total male customers captured.

DTC brands offering services

Services is a large growing segment of the wellness market. To tap into this trend, DTC brands are increasingly offering experiences.

For instance,Pelotonexpanded its service offering to provide subscriptions for its fitness app, live virtual workout classes, and in-person sessions, helping it reach customers who may not have Peloton workout equipment.

Fitness class company CrossFit launched a virtual primary care service in partnership with Wild Health––Crossfit Precision Care. For $100 per month, subscribers receive personalized health offerings that take genetic insights from a DNA kit to better build care. Users can also review their health metrics within the platform.

Wellness brands with a solid customer base can tap into their strong brand power and loyal customer bases to create virtual wellness services.

People own more smart exercise equipment

During pandemic-induced lockdowns, people looked to buy new equipment to bring their gym routines home.

Some of these purchases included smart fitness equipment created by the likes of Peloton and Lululemon.

This year,42.6 million US adultswill use a connected fitness platform such as Peloton at least once a month. This figure ballooned from 24 million in 2019.

As people continue to work from home in 2022 and beyond, the trend for at-home connected fitness has continued and looks set to grow.Sixty percent of US consumershave continued to work out at home the majority of the time as of June 2022.

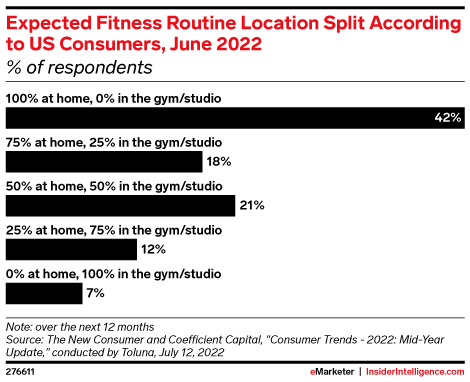

Plus, just 7% of US consumers who exercise expect to work out entirely at a gym or studio for the next year. By comparison, 42% plan to exercise only at home, while the rest anticipate using some combination of the two.

DTC brands are tapping into consumer preferences for at-home workouts and bridging the gap between gym and at-home workouts with smart exercise equipment.

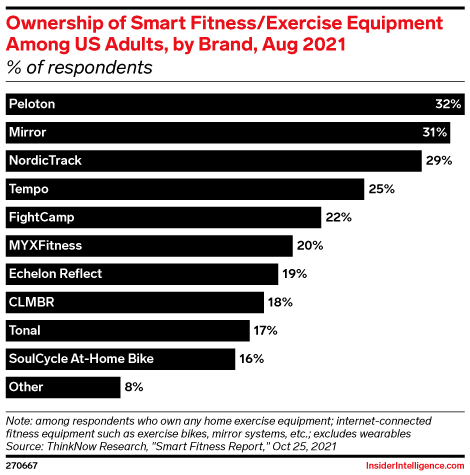

Currently,Peloton and Lululemon’s Mirrorhave the lionshare of smart fitness equipment.

Peloton is the most popular smart fitness brand, with32% of US adultswho have home fitness equipment owning its products. Despite that dominance, the company is behind Nike and Lululemon Athletica in US direct-to-consumer ecommerce sales.

Lululemon’s purchase of Mirror provided it with a digital offering to support its main fitness-apparel business. Through the device, users can stream more than 10,000 classes, including pilates and HIIT in their home gym. Instead of people having to go to their nearest studio, they can get a top-tier training experience in their own homes.

To bridge the gap between remote and in-person workouts, Lululemon has also launched in-store fitness, nutrition, and mindfulness offerings.

Some brands provide the option to work out via a mobile app alongside a trainer on the go or at home. Smart fitness brands also provide people with a community element to their workouts––something that’s both empowering and energizing.

Smart fitness users can work out and engage with each other in multiple ways, depending on the exercise equipment. Peloton for example promotes its Leaderboard, Video Chat, and Here Now features. Lululemon’s Mirror encourages user engagement by using community cameras.

Smart fitness equipment has developed into a shared community experience where consumers can choose when and how they work out while engaging with other like-minded people.

Consumers download apps to help them build solid health and wellness routines

As people continue to exercise from home and adopt remote-friendly workouts that don’t require a physical gym space, consumers are increasingly turning to workout apps.

According to Statista, in 2022, themost common fitness and health online servicesthat consumers in the United States spent money on were fitness, yoga, and training apps and health tracking apps. Plus, some of theleading health and fitness appsdownloaded globally in the Google Play Store included weight loss apps and home workout apps.

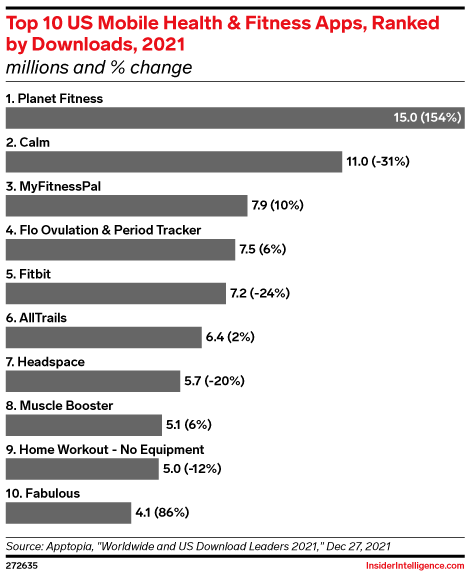

Currently, the top US mobile health and fitness apps includePlanet Fitness and Calm. The rest of the top 10 list shows an even spread between meditation, health tracking, and workout apps.

To tap into the trend, wellness brands can evaluate how their offering could be packaged into a health-oriented community-based app. For instance, theNike Training Club appaims to help users’ fitness habits stick with them. There’s free guidance from trainers, athletes, and nutritionists. Users can also participate in a catalog of free workouts including restorative yoga, HIIT, and bodyweight burn.

The rise of the “wellness metaverse”

While the metaverse is still a novel concept, consumers are already looking for ways to improve their daily routines and experiences.百分之六十的美国青少年and adults believe that virtual environments will make it significantly easier to find a fitness or exercise routine.

The growing “wellness metaverse” will create new opportunities for each segment of the surging wellness economy. Health and wellness brands may choose to use the metaverse in the following immersive ways:

- Immersive mindfulness sessions

- Interactive cookery classes

- Virtual workouts

- Gamified exercise

For instance, Fitness VR apps in the metaverse like Supernatural and Beat Saber combine upbeat music, high-intensity workouts, and virtual coaching to create an engaging and fun exercise experience.

As these metaverse experiences are in their infancy, there’s room for improvement when it comes to user experience. In the past year, some users have complained that the fitness data in these apps is hard to export into fitness tracking apps or wearables.

In arecent blog post元说,所有用户健康数据将年代yncable to the Apple Health App, and the Oculus Mobile app on iOS.

“This means all your exercise stats, including your activities both in and out of VR, can be tracked and available in one place,” Meta said.

These new integrations should help retain users, especially consumers who already rely on Apple devices for fitness-related activities.

Meta’s developing tech will also encourage iOS and Apple Watch users to try out VR fitness apps and close their activity rings. As Apple continues to develop its wearables lines, including future goggles, metaverse-based wellness activities will continue to grow in variety and popularity in 2023 and beyond.

Younger generations look to AR to take fitness classes

AR and VR are becoming increasingly popular. Once a dystopian-sounding concept, used only by young gamers, it’s now helping people access more exercise classes from home.

Using the tech, people can participate in augmented reality fitness classes or share their fitness progress with social media followers.

Thanks to its ease of use, augmented reality looks set to grow in popularity––according to eMarketer, in 2023, around97 million peoplein the US are expected to use AR at least once a month.

AR is particularly effective for engaging with younger fitness enthusiasts like millennials and Generation Z.Forty-eight percent of Gen Z adultsexercise several times a week, and 24% do it several times a month. This strong interest in exercise, combined with their use of social media, makes them likely to be interested in augmented reality fitness.

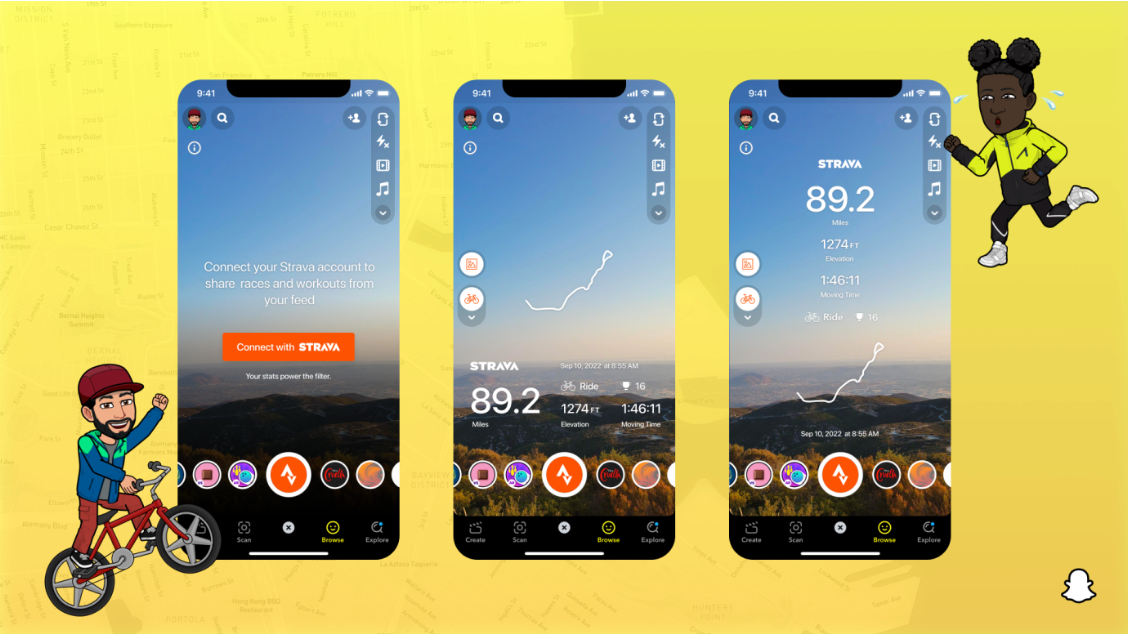

例如,提前与健身应用和合作tracker Strava to create a new AR lens that lets users share interactive visual updates of their fitness activities. The Strava Activity Lens provides AR overlay options on Snapchat’s camera display, using data from Strava so users share their recent workouts on the Snap Map.

Snap users tap Strava’s lens to take a Snap or post a story using AR overlays to show an exercise route, pace, distance, or other fitness-related data.

Other brands use AR to help users make the most of their workouts. Some tools are smartphone compatible, while others use smart glasses that work with apps like Solo Wearables or an AR-enabled wearable device.

The AR wearables market is growing––it was valued at$62.11 billion in 2021, and is expected to be worth $145.49 billion in 2027. This could be a big upshot for the AR fitness industry, due to the inconvenience of holding smartphones while exercising. Using hands-free AR, people can experience safer and more effective workouts.

One of the pioneering examples of an AR gamified app created to encourage exercise is Zombies, Run. To motivate runners, the app plays commentary from helicopter pilots who guide users on how to outrun the zombie apocalypse.

Other examples of AR apps include mindfulness exercise apps that create visualizations based on the users’ breathing.

Men’s personal care brands continue to grow in popularity

While wellness and personal care have traditionally been targeted at women, there’s increasing demand for men’s personal care products too.

The global men’s personal care market size was valued at$30.8 billion in 2021and is expected to expand at a compound annual growth rate (CAGR) of 9.1% from 2022 to 2030.

There’s increasing demand for gender-specific products like shampoo, soap, face masks, and peels. Plus, growing numbers of men are purchasing their own personal care products instead of having a partner or family member do it for them.

Dr. Squatchis one example of a men’s care brand tapping into this increased demand. Founded in 2013, the DTC brand began with an online shop that sold natural soap bars. In November 2022, Dr. Squatch launched a new line of natural body and hand lotions, adding to its product line of hair care items and deodorant.

To connect with its target audience, the brand focuses on using humor to educate men about the benefits of using natural personal care products.

“Guys don’t necessarily talk about personal care in a way, generally speaking … that women do and, so there’s an element of having to really find ways of connecting with them that are unique,” Josh Friedman, chief marketing officer at personal care brand Dr. Squatch,told Retail Brew.

Shopify merchant grooming brandManscapedis another men’s personal care brand that has seen popularity for its offering soar. In late 2022, the business announced it successfully finished an undisclosed Series B funding round that will be used to boot product expansion in 2023.

“By listening to our customers and focusing on innovation, we continue to expand our offerings to include products that men want and need to elevate their self-care routines. We’re looking forward to a robust product roadmap in 2023 and beyond,” Manscaped founder and CEO Paul Train toldRetail Brew.

Tap into these health and wellness trends in 2023

The health and wellness market is growing and shows no signs of slowing down. Consumers are set to continue prioritizing health care and their well-being next year, meaning they’ll likely spend more too.

But the wellness segment is also becoming more competitive, so brands need to think about how they can best engage with target consumers.

Focus on tapping into a few core trends including:

- Creating personalized wellness experiences

- Building authentic influencer campaigns

- 创建虚拟健身课程

Depending on your brand and audience, see what resonates with customers best and how you can meet their needs. Then convince them to become repeat customers with recurring subscriptions and fresh experiences.

Health and wellness trends FAQ

Is the health and wellness industry growing?

In 2022, the global wellness market is projected to hit$5.59 trillion. By 2025, it’s expected to reach nearly $7 trillion––a 25% increase.

- What are the four areas of health and wellness?

- Mental wellbeing

- Physical fitness

- Sleep

- Nutrition

What are the main health and wellness trends for 2023?

Core health and wellness trends to follow in 2023 include:

- The rise of the “wellness metaverse”

- People taking AR fitness classes

- Consumers owning smart exercise equipment

- More people using apps for workouts

- An increase in the popularity of men’s personal care