If you sell in the United States, you’re likely familiar with the frustrations that come with managing sales tax. That’s why Shopify is introducingShopify Tax.

Now, you can access tax-specific features directly in your admin. Know where your business is liable and collect the right amounts at checkout.

As your business grows and you become responsible for collecting sales tax, you have to:

- Track your sales in each state

- Parse through state requirements to determine when to start collecting tax

- Register with each state as required

- Make sure you’re collecting the right amount based on the specific tax rules that may apply to your store and your customer’s delivery address

- Remit the right amount, to the right jurisdiction, at the right time

- Stay on the lookout for unexpected regulation changes

Managing this process across the 46 states (and over 11,000 different jurisdictions) that collect sales tax is enough to make anyone want to throw their hands in the air and give up.

Shopify merchant Bryce Rieger, co-founder of Side Fold Media, shared a similar perspective on the complexity of US sales tax: “It becomes very discouraging. I’ve talked to a lot of other merchants where things are going along hunky-dory, life is good, and then dealing with tax took the wind out of their sails.”

It’s clear that many merchants are in need of a product that makes sales tax in the United States less frustrating. That’s whereShopify Taxcomes in.

Shopify Tax helps merchants solve sales tax issues in three common areas of concern:

- Knowing where you’re liable for state tax

- Calculating and collecting taxes from customers

- Reporting and filing taxes

Learn the nexus conditions for each state

Shopify has a helpful sales tax reference page for learning the sales tax rates, collection rules, and nexus conditions for each state.

See nexus conditionsKnow where you’re liable for state tax

Until 2018, businesses were only required to collect sales tax if they had a physical presence in that state. For most small businesses, it was fairly straightforward to know where you were liable: Have an office, employee, warehouse, or other physical entity in a state? You likely need to collect sales tax. Don’t have a physical presence? No requirement.

However, the 2018South Dakota vs. Wayfair Supreme Court decisionchanged everything. In order to ensure large online retailers were paying their fair share of taxes, a new concept was created: economic nexus.

Because of that change, if your business makes more than a certain dollar amount in sales in a state, or exceeds a certain number of transactions, you now have an economic nexus in that state and are subject to the same sales tax collection rules as a business with a physical presence.

What makes this process more complicated is the fact that every state has different rules regarding economic nexus. It’s enough work to understand the thresholds for one state and how it applies to your business, but merchants have to do this for each of the 46 states that collect sales tax.

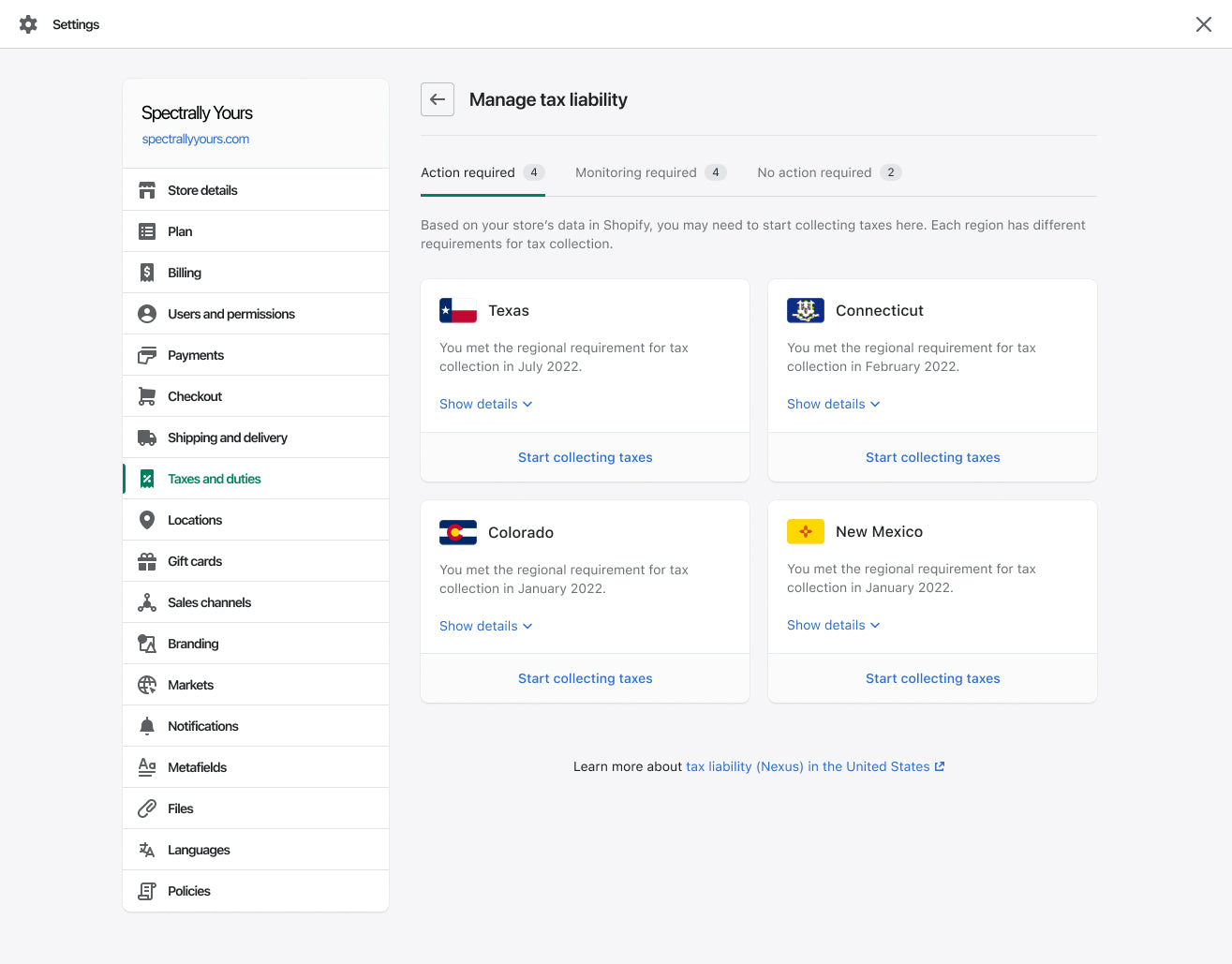

Thesales tax insightsfeature within Shopify Tax solves this struggle. It takes the stack of rules and requirements needed to determine when you’re required to collect US state sales tax and automates it.

In theUnited States sectionof the Taxes and duties page in your Shopify admin, you can find out the locations in which you may be obligated to collect tax and where you may soon cross tax thresholds. From there, you can find helpful links to relevant tax agencies.

Each business is unique, so the sales tax insights are designed to empower you to make an informed decision alongside your accountant or trusted tax professional. Sales tax insights are available to all merchants selling in the United States and Canada, and included as an added benefit of your Shopify subscription, regardless of which plan you’re on.

How to calculate and collect taxes from customers

Once you register with the state, it’s time to collect taxes from your customers. With more than 11,000 sales tax jurisdictions in the United States and numerous product-specific tax rates, how do you know you’re doing so accurately?

Shopify Taxhas two solutions to help you collect the right amount of tax based on product type and customer location:smart categorizationandrooftop accuracy.

Designate product tax rates with smart categorization

Is a hot dog a sandwich? As a society, we may never be able to agree on an answer, but Shopify Tax can help you categorize your sausage-based sandwich for tax purposes.

If you live in New York, you may find that you pay tax when you buy a hot dog from your local stand, but not when you buy a pack for your neighborhood barbecue. In each state, different rules govern the amount of tax that should be assessed on your product.

That’s wheresmart categorizationcomes in. Smart categorization works on your behalf to decode taxation rules whenever you add a new product to your Shopify store. Based on the description you enter, Shopify recommends aproduct categoryfor you. Once you approve or modify the recommended category, Shopify automatically assigns the proper tax rate based on local regulations so that your customer pays the right amount at checkout.

Confirm tax rates with rooftop accuracy

When you buy your favorite product online, have you ever wondered what goes into the sales tax you’re charged? In the US, what you pay is actually a combination of taxes assessed at the state, county, city and district level. You may be surprised to learn your neighbors down the street are paying a different amount than you are, even if you live in the same city and have the same ZIP code.

With this level of specificity required to accurately calculate tax rates, historical systems that use city- or ZIP code–level precision won’t cut it if you want to be more confident at tax time.

Shopify Tax usesrooftop precision在检验优化你的准确性。当你的customer checks out, Shopify reviews the specific sales tax requirements for their exact delivery address and collects the right amount.

When a purchase is made, you can review the order summary to determine the specific taxes that have been assessed and collected, with line-item detail down to the district level. This information can be pulled from your tax reports when it’s time to file and remit your taxes.

Make filing taxes easier with enhanced reporting

When it's time to file with the state, how do you show you’ve collected the right tax amount and send the money to the right place? For many merchants, this is the hardest part of the process.

Reconciling your sales and tax data into the format required by each state and then filling out the required forms can take hours or days of work.

With Shopifysales tax report, merchants have near-instant access to all the information they need to file. This report provides both net sales and taxable sales, breaks both down by state, county, and local-level jurisdictions, and shows the exact reporting code.

Transaction details are available to show how each order contributed to the totals. What once might have taken days or hours can now be done in a fraction of the time.

How Shopify is building for the future of sales tax

As Shopify merchant Bryce Rieger says, “Sales tax is extremely disjointed. There are so many steps and nobody owns any of them. Everyone will do a piece, but then they pass the buck or point at someone else.”

Shopify solves old and disjointed US sales tax procedures by building a solution right into your store. Start exploringShopify Tax’s features today and submit your feedback.

Every merchant is unique. If Shopify Tax isn’t for you, theApp Storelets you incorporate the tools you need for tax reporting, filing, and insights—with end-to-end solutions powered by the most trusted tax services coming soon.

好像只有两个必然rce: that you’ll have to pay taxes, and that Shopify has your back.

Explore Shopify TaxThis content was updated in August 2023.