Interested in exploring ways to achieve financial freedom? While it won't magically make you rich overnight, passive income offers opportunities to supplement your earnings with minimal ongoing effort. Explore passive income ideas to generate extra income and build a more secure financial future.

Key Points

- Most successful passive income ideas are the result of hard work and repeat gains.

- Adding passive income streams to your life can give you more freedom, flexibility, and money.

- Dropshipping is one of the best passive income ideas to earn money from wherever you are.

Check out our guide towhat is passive incometo learn the basics of passive income.

Read more to discover 30 easy passive income ideas to get started with today!

Table of Contents

- Start a dropshipping store

- Create a print-on-demand store

- Sell digital products

- Teach online courses

- Become a blogger

- Sell handmade goods

- Run an affiliate marketing business

- Sell stock photos online

- Become a social media influencer

- Buy a rental property

- Invest in the stock market

- Rent out your spare room

- Rent out your car

- Lend money to peers

- Earn while shopping online

- Buy and sell websites

- Start a YouTube channel

- Invest in REITs

- Sell designs online

- Invest in businesses

- Rent out unused space

- Create a job board

- Create no-code apps

- Write a digital guide

- Earn royalties through inventions

- Record audiobooks

- Invest in vending machines

- Build and sell spreadsheets

- Open a high-yield savings account

- Rent out your parking space

30 Easiest Passive Income Ideas

1. Start a dropshipping store

Dropshippingis one of the best passive income ideas to earn money from wherever you are, even if you don’t have a lot of cash flow to begin with. Some dropshippers report making upward of$100,000 per year.

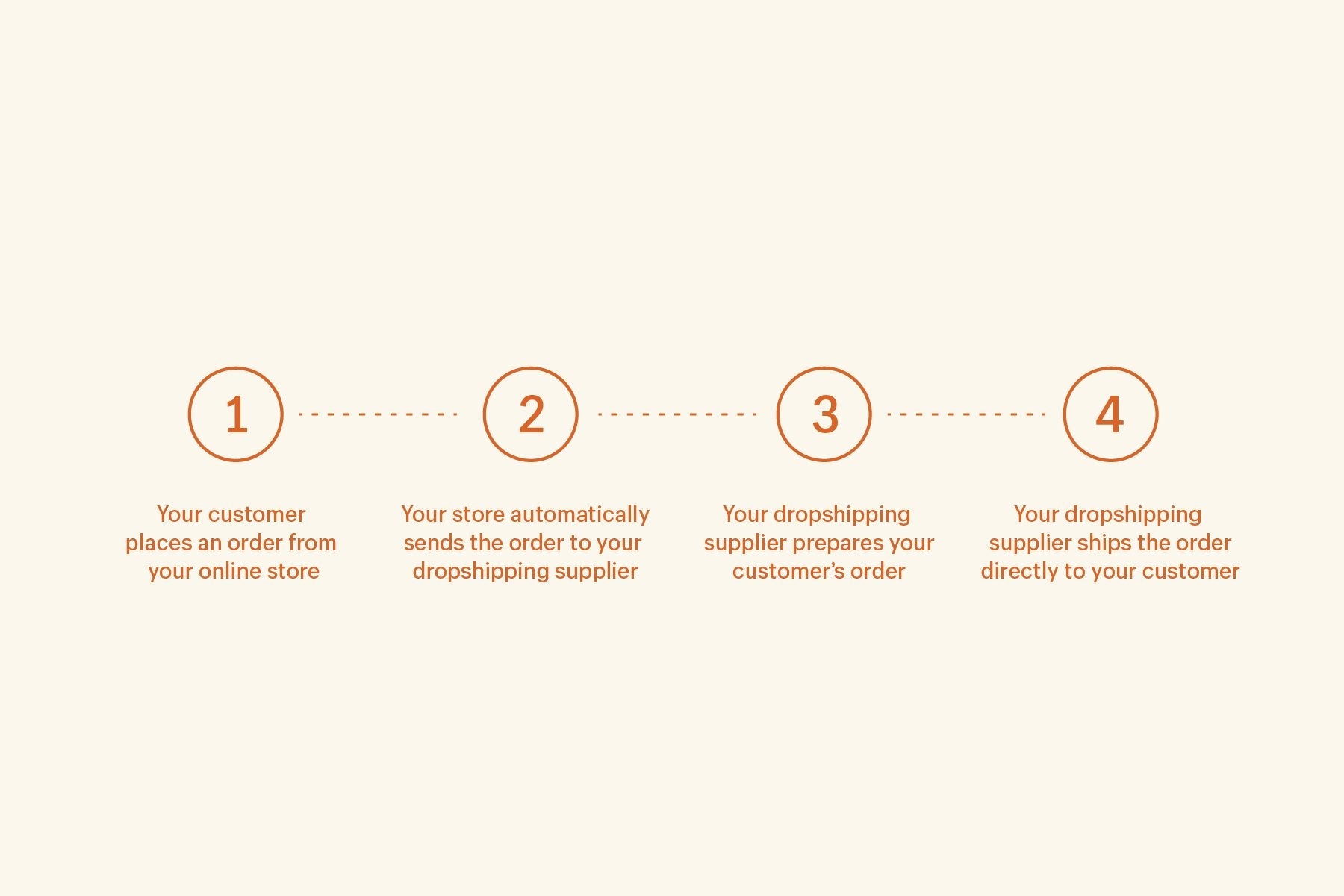

The dropshipping business model involves creating anecommerce storewhere customers browse and buy products. What’s interesting about dropshipping is that you don’t have to see or physically manage the products you sell.

With dropshipping, your supplier handles everything from manufacturing to packaging to fulfillment. And since you don’t need to send money to your supplier until your customers pay, this passive income business has limited cash risk. You can use a platform like theDSersto find trending products in different niches to sell in your store.

TIP:With Shopify, it’s easy tostart a dropshipping business和没有hOB欧宝娱乐APP开始销售assle of managing inventory, packaging, or shipping. Orders are sent directly from your wholesaler to your customers, so you can work on what matters—your products, marketing, and customers.

2. Create a print-on-demand store

If you’re an artist, designer, or entrepreneur, print on demand can be a profitable income stream and monetize your creativity. It involves working with suppliers to customizewhite label productslike t-shirts, posters, backpacks, or books and selling them on a per-order basis.

Similar to dropshipping, you only pay for the productafteryou sell it. There’s no buying in bulk or inventory needed. Print-on-demand stores are a good passive income stream because:

- You can create products quickly and put them up for sale in minutes

- Shipping and fulfillment is taken care of by your supplier

- Once your store is set up, you can automate many marketing and sales processes

With a print-on-demand company likePrintful, you can quickly and easily create products to sell in your Shopify store. Overall, print on demand is a simple, low-risk passive income source you can get up and running fast.

3. Sell digital products

Digital products are assets or pieces of media consumers can’t touch physically. These include downloadable or streamable files such as Kindle books, templates, plug-ins, or PDFs.

Digital products are great income sources because they have high profit margins. You only have to make the asset once, and you can sell it repeatedly via your online business. There’s no storage or inventory needed.

You can sell as many digital products as you want. Many creators scale passive income from digital assets by selling kits, printables, files, and other materials professionals can use.

4. Teach online courses

It’s easier than ever for educators to sell courses online. Whether it’s marketing, illustration, or entrepreneurship, you can create pre-recorded courses and start selling with few limitations. You can sell online courses repeatedly without holding any inventory or stock, generating passive income.

Teaching online requires some upfront investment in time. You’ll need to outline your course, record it, and create downloadable assets like templates for students to walk away with.

Whichever way you look at it, teaching an online course is a great way to generate income at a low startup cost, other than investment of time.

5. Become a blogger

Starting a blog can be a challenging venture, but the blogging business model is only becoming more successful as a passive income stream.

It takes a little bit of time to build a blog. But if you create quality content and promote it through your platforms, you’ll build an audience big enough to generate a significant income stream.

You could earn passive income from blogging by:

- Selling affiliate products

- Creating sponsored posts

- Selling your own products

- Running ads through Google AdSense

The best part? You don’t need any design or coding skills to start a blog. With a content management system and hosting service like Shopify, you can get a blog up and running in no time.

6. Sell handmade goods

There are hundreds of online sites you can sell on. Some have specific niches, like video games or handcrafted goods, while others let you sell whatever you want.

Some popularonline selling sitesinclude:

- Handshake

- Amazon

- eBay

- Ruby Lane

- 阿里巴巴全球速卖通

前期投资是双重的。你需要invest in materials and time tomake and sell DIY goodslike pottery or clothing. You’ll also want to create an online store to house your products.

Selling from your own store reduces the amount of fees you pay on each sale, plus, you can create a brand for yourself. The benefits of building a brand compound over time as you grow an audience and connect with more customers. It’ll help you sell more over time and make money online.

7. Run an affiliate marketing business

Affiliate marketinginvolves recommending a product or service to an audience. It’s a great source of passive income because you earn a commission whenever someone uses your referral link to buy the recommended product or service.

Online entrepreneurs become affiliate marketers for a few key reasons:

- It’s easy to execute.You just handle the marketing side of things. The brand will develop products and fulfill orders.

- It’s low risk.There’s no cost to join anaffiliate program. You can sell established profits without any upfront financial investment.

- It’s scalable.Affiliate marketers typically don’t hire extra help. You can introduce new products to an audience and create campaigns while your past work makes money in the background.

Earning money with affiliate marketing can be a rewarding way to add new revenue streams to your business. All it costs is your time. Once the hours are invested, you can reap the rewards continually.

8. Sell stock photos online

Unlike many of the other passive income ideas on this list, photography is a service-based business, which typically means you get paid for your time. You must be at an event or photoshoot to make money with photography, which, even if you’re making a killing, can be tiring after a while.

However, if you’re a full-time photographer or own a good camera, you can generate passive income from photography by selling photos online. Stock photo sites like Pexels, Shutterstock, and other online media houses will pay for high-quality photos and videos.

If you run your photography business on Shopify, you can also easily tie in digital products like prints or print-on-demand products like shirts and hats, giving you even more passive income streams so you can work less and make more.

9. Become a social media influencer

To become a social media influencer—someone who can sway another person’s buying decisions—you’ll need to build a community of people who enjoy similar topics.

Are you a comics fan? You can create an Instagram account and start posting consistently about the latest Marvel and DC shows. The same applies if your interest is in sports, scuba diving, home décor, or even general culture.

If you have an engaged audience, you use that engagement to support a variety of passive income ideas. For instance, you can partner with large and small businesses to promote their products to your followers. Or you can make money through selling your own merch.

TIP:Shopify Collabsmakes it easy to find brands that match your vibe, build affiliate relationships, get paid for what you sell, and track everything in one place.

10. Buy a rental property

房地产我nvesting is one of the oldest ways to build long-term wealth in general, and passive income in particular.

If you have enough money, you can buy apartment buildings or some other form of real estate and lease them out for rental income. But since the job of being a landlord is pretty active, you can hire property managers to manage tenants, maintain properties, and collect monthly payments or rent.

As a bonus, your properties will appreciate as the housing market rises, increasing your profits in the event of a future sale.

11. Invest in the stock market

Although the stock market might have a steep learning curve and can be confusing, it’s a great way to build lasting wealth. A common mistake most people make with investment funds is thinking short term instead of playing the long game to reach financial goals.

The goal for investing in stocks is to diversify your portfolio and reduce risk. You can do this through investing in mutual funds, index funds, exchange-traded funds (ETFs), and high-dividend stocks that earn you capital gains over time.

To start investing in the stock market, you need to open up a brokerage account at a quality financial institution and fund it. It’s recommended that you also speak with a financial adviser to help plan and hit your passive income strategy goals.

12. Rent out your spare room

Maybe you don’t have the startup capital to invest in rental properties. But do you have an extra room in your apartment? Or are you going on a three-week road trip and don’t want to leave your house empty? You can partner with a rental company like Airbnb or VRBO to put your free space up for rent.

Airbnb connects homeowners with people who are looking for their next getaway. People prefer Airbnbs because they’re sometimes cheaper and often more convenient than hotels, meaning a high demand for your free space as an Airbnb host.

While renting out one spare room to earn passive income is great, renting out 10 is even better. If you want even more income from Airbnb, you can (depending on local laws) buy apartments for the sole purpose of renting them out. You should note, though, that renting your space out often requires work upfront. You might have to furnish or renovate your space before putting it up for rent.

13. Rent out your car

Your home is not the only thing you can rent out to earn passive income. You can also offer your car up for rent with a service likeTuro. If you already use your car as an Uber, you can sign up with platforms likeCarvertiseorWrapifyto earn extra money as you take trips around town.

Another way to turn your car into a income stream is to look for someone who needs a car for Uber or Lyft. So instead of actively driving around in your free time, you can pull up a Netflix show while your car works for you.

14. Lend money to peers

Have extra cash that’s not working for you? Try peer-to-peer lending as aside hustle. Peer-to-peer lending involves lending money to borrowers or small businesses.

简化这个过程,你可以在网站注册site likeLendingClub,Prosper(for individuals), orWorthy(for businesses) that connects borrowers with lenders.

These sites usually host loan requests along with interest rates based on the borrower’s history. The return on these loans is usually around 5% to 6%. The more you lend, the higher your cash flow will be.

15. Earn while shopping online

Cashback reward sites like Swagbucks, MyPoint, and Rakuten allow you to generate passive income when you shop online. After signing up, you don’t have to do anything extra, aside from shop, to make money from these sites. The more you shop online, the more points you gain. And the more money you can make.

A note of caution: don’t exceed your monthly spending budget or max out your credit card in a bid to earn some reward.

16. Buy and sell websites

Websites abound on just about any topic you can think of. The best part? A lot of them make a healthy income through the likes of affiliates, ads, memberships, or products—and they’re often put up for sale.

Sites like BizBuySell make it easy to buy and sell online stores securely once you open and verify an account.

It’s a great way to own a business that already has some sales and traffic coming in. Once you complete your purchase, you also get access to seller support afterward to ensure you do well.

17. Start a YouTube channel

It’s not too late to start a YouTube channel. A whopping2.6 billion peoplearound the world use YouTube every month. That’s a lot of eyeballs to capture for passive income. The catch? It’s a lot of upfront work for little to no return in the beginning.

Yet, if you’re a long-term thinker and don’t mind frontloading your efforts, the income potential of a successful YouTube channel is high. Affiliate sales, sponsorships, branded integrations, and ad income can all add up passively as you accumulate content, clicks, and views and grow your audience. You can even easily spin off into starting a podcast and earn more money through sponsorships.

18. Invest in REITs

What if you don’t have money to buy entire apartment buildings? Can you still earn rental income? Yes, you can.

With a minimum investment of $500, you can use a real estate investment trust (REIT) platform likeFundriseto invest in a variety of real estate assets—and earn more passive income as the assets appreciate. A REIT is a company that owns and manages profitable real estate. It’s a great way for smaller investors to pool their money to afford investments they wouldn’t be able to afford by themselves.

作为一个长期的投资,房地产投资trusts are one of the best income ideas to look into if you have startup capital. Besides upfront capital, getting started also takes some in-depth research. This isn’t an investment you want to walk into blindly. Thankfully, there are plenty of resources,like this guide, to help you get started.

19. Sell designs online

Design websites like99designs,ThemeForest, orCreative Marketare great places to generate a passive income stream by selling digital designs online. Whether you use awebsite builderto build website themes, logos, branding resources, templates, illustrations, or even fonts, these platforms offer a built-in market that is already looking for design resources.

For instance, if you wanted to start selling designs on Creative Market, you’d need toapply and wait for approval. From there, you get your own storefront, where you can start selling your branded designs.

20. Invest in businesses

Today, getting started investing in historically inaccessible business opportunities is absolutely possible. Platforms likeMainvestmake it easy to invest passively with a $100 initial investment without any of the investor fees.

The returns? As with any investment, it depends. But Mainvest aims to earn you anywhere from 10% to 25%. You don’t even have to vet the businesses yourself. Mainvest takes care of the vetting process for you. You simply invest the capital to get started.

As a passive income idea, this is a great, safe way to step into the business investment world and learn as you go.

21. Rent out your unused space

Have a basement or garage you aren’t using? Rent it out as storage space! It’s possible to do this safely and efficiently with storage rental platforms like:

The storage industry is projected to grow to as much as$64 billion by 2026. In other words, this isn’t an income idea that’s going away anytime soon. You can store a variety of items, including cars, boats, RVs, or even business inventory.

Using storage rental platforms is also a great way to avoid liability issues, as they provide safe payment options, contracts, and storage provider and client information.

22. Create a job board

A job board is a great way to earn passive income as an online entrepreneur. These websites are used by employers to promote job vacancies to job searchers.

Job seekers can look for new job opportunities online or in-person. You can charge employers to post on your job board and offer premium features like sponsored jobs or unlimited access to your candidate database.

Even if you don’t want to design a job board from scratch, you canbuy a job board themeand start generating passive income right away. Now, building the website is the easy part. Creating awareness of your job board is where the bulk of the work is.

Once you get the flywheel going and your job board becomes established with return customers, you can count on a large part of your income to be passive. Check out sites likeProBlogger,Dribble, orConstruction Jobsfor inspiration.

23. Create no-code apps

The fact that any novice can create a basic to advanced mobile app with today’s no-code tools is beautiful. Platforms likeAppy Pie,Adalo, orBubblemake it possible to get started.

To start, you’ll have to decide whether you want to create a website or mobile app. Besides the concept of the app (what niche it will serve and what problem it will solve), there’s also monetization to think about.

You can generate passive income with a mobile app using:

- Subscriptions

- Ads

- Pay to download

- A marketplace model

If you aren’t sure what problem your app should address,here’s a great list of research toolsto help you get started.

Ubersuggest can give you insight into what keywords have high search volumes.

From there, it’s a matter of setting up your digital guide to collect sales, whether that’s throughyour own storefrontor a seller platform.

25. Earn royalties through inventions

Inventors aren’t a thing of the past. You can make passive income through your unique inventions. Though this isn’t a passive income route that’s talked about often, it’s a real one.

Getting started is probably one of the hardest parts of the inventor’s journey. You want to make sure you have a worthy invention that’s useful and solves a problem. Start by checking out the美国专利网站to make sure your idea hasn’t already been created.

If you want to outright sell your invention, sites likeInvention Citycan help you get started. Depending on the deal you strike, you can passively earn a percentage or payouts from the income generated through your idea once it’s on the market.

26. Record audiobooks

Audiobooks have to be created by someone. Why can’t that someone be you? Once you break into the industry, it’s possible to create passive income in the form of royalties—which is how most audiobook narrators get paid.

To successfully make income from audiobooks, there are a few things you need to master first. These include learning:

- How to audition

- Proper narration technique

- What niche you’ll work in

- Some editing skills

You don’t have to go at it alone. Some platforms make it easier to get started and land your first few gigs. Check out sites likeACXto learn what you need to make it in the industry.

27. Invest in vending machines

Ever wonder who takes care of all those vending machines that are always stocked? The owner of those machines is earning (semi) passive income from your snack and soda cravings.

Starting a passive source of income through vending machines does require an upfront time and money investment.This is a great guidewith tips on how you can get started with your first vending machine.

Marketplaces likeCraigslist,eBay, orBizBuySellcan help you gauge the upfront investment you’ll need to buy your first set of machines (as well as how many you can afford to start). Once you secure areas where you can install them, a route of vending machines makes for a great cash-flowing source of largely passive income.

28. Build and sell spreadsheets

Some of us are natural-born spreadsheet masters. If that’s you, it’s possible to put your spreadsheet skills to work to earn passive income.

Whether you create spreadsheets with Excel or Google Sheets, there’s a market that will pay for you to create spreadsheets for all kinds of purposes:budgeting, profit projections, habit tracking, or even P&L spreadsheets that business owners don’t want to create from scratch.

Pair a Shopify storefront with theDigital Downloads appand you have yourself a passive income stream ready to earn money. For that to happen though, you do need to drive traffic to your storefront. Thankfully, we have some resources to help.

29. Open a high-yield savings account

A high-yield savings account generates passive income by offering a higher interest rate than traditional savings accounts. By depositing money into this account, you earn interest over time without any additional effort. Some high-yield savings accounts and certificates of deposits offer over 4% APY.

这种兴趣acc本质上是“免费的钱”umulates as your savings grow. Although the returns may be lower than other investments, high-yield savings accounts offer a safe, low-risk option for beginners to start earning income and building wealth.

30. Rent out your parking space

Renting out unused parking spaces can generate passive income, requiring minimal effort. By listing your available spot on a parking-sharing platform or through local ads, you can monetize the empty space.

Renters seeking convenient parking will pay a fee, creating a steady stream of revenue with low maintenance, while you enjoy the financial benefits.

Passive income to financial freedom

There is only so much time in a day, and finding ways to make a lot of money more efficiently can give you flexibility in your personal finance to hit the next level. That level might be taking a nice vacation or buying that awesome pair of shoes, but whatever it is, adding passive income streams with different underlying economics can give you the freedom to explore it.