Customer disputes are a reality ofaccepting credit card payments. But that doesn’t make them any less frustrating. Some90% of merchantssaid “cardholder abuse of the chargeback process” was a leading concern for their business.

Chargebacks result from a customer questioning or disputing a transaction with their issuing bank. It’s relatively easy for customers to initiate a dispute, which is why chargebacks cost retailers0.47%of their total revenue annually.

This guide shares an overview of chargebacks, how the dispute process works, and how to prevent them in your online store.

What is a credit card chargeback?

Chargebacks occur when a cardholder asks their bank to reverse a transaction. Chargebacks are also known as payment disputes. They provide consumer protections and reimbursement from fraudulent transactions.

When cardholders suspect their card has been fraudulently used, they can request a chargeback from their issuing bank. After the issuing bank investigates the claim, it will refund the cardholder if debit or credit card fraud is discovered.

If a chargeback occurs, the funds are held until the bank resolves the issue. There is a short time limit in which you can contest the chargeback and prove that the transaction was legitimate. It’s generally between 60 and 90 days, but varies depending on thepayment processor.

The bank returns the money to your merchant account if you can prove the disputed charge is valid.

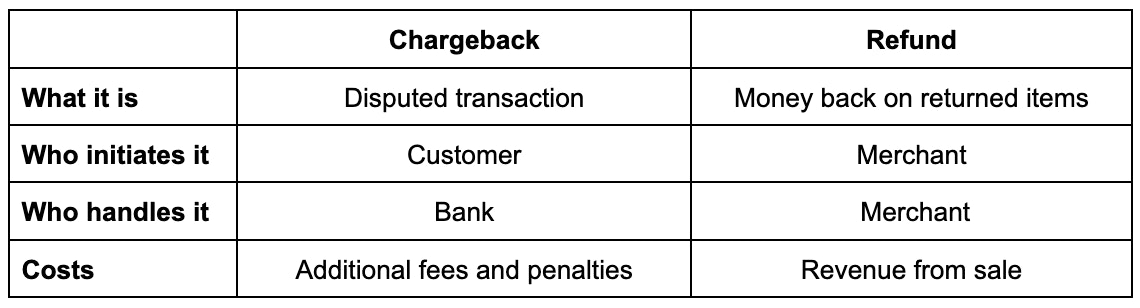

Chargeback vs. refund

There is often confusion between these two terms, so let’s quickly look at the differences.

- Chargebacksoccur when a cardholder disputes a transaction with their issuer and the issuer contacts the merchant to reverse it.

- Refundsoccur when a merchant voluntarily refunds a customer without the card issuer's involvement.

For business owners, chargebacks and refunds differ in several ways:

- Acustomer will go straight through their bank to initiate a chargeback.With refunds, they will come right to you. The refund process gives you a chance to fix the issue and make the customer happy.

- Youcan incur extra fees if a customer’s chargeback is accepted. You can also be put on a monitoring list and have your account canceled with the issuer.

Penalties for chargebacks

Chargebacks can be a big pain for small business owners:

- You may have to pay the chargeback fees if the dispute is successful, ranging from $15 to $100.

- If repeated chargebacks happen, you can be placed on a monitoring program, leading to higher processing fees and termination of your account.

To prevent chargebacks from happening, you must know how chargebacks work and take steps to prevent them. For example, you can clearly state your refund and return policies, ensure that goods and services meet customer expectations, and issue refunds quickly.

TIP:Shopify’s fraud analysishelps you identify potentially fraudulent orders. You can review high-risk orders in your admin to avoid chargebacks.

Taking on high-risk orders can result in a higher number of chargebacks, which can lead to disabling payment processing and removal from Shopify Payments.

How do chargebacks work?

Payment processing companieshave their own processes, but generally follow these steps:

- The customer makes a purchase.Someone buys a product with their credit card. The transaction may take place in-store, online, or on amobile point of sales (POS).

- The customer initiates a chargeback.The customer contacts their credit card issuer and disputes the charge on their statement. The issuer checks internal transaction data, like timestamps and location data. They look to confirm the customer made the purchase, or if it was fraudulent.

- The issuing bank reaches out to the merchant.The card issuer will ask your bank for evidence to prove the purchase was valid. You may have to include invoices, proof of delivery, receipts, or other evidence to counter the claim.

- The cardholder’s bank makes a decision.The bank will reverse the chargeback if you can show that the charge is valid. If you cannot provide evidence the purchase is valid, the customer is refunded and you’ll be charged a fee.

- The bank informs the customer of the decision.The bank will inform the customer of its decision by mail, email, or phone. A customer may appeal the decision if they don’t agree with the verdict.

In the worst-case scenario, the situation will go to arbitration. Arbitration is a method of resolving disputes between two parties. It’s like a less formal court. Each party presents their case to an arbitrator, who makes a decision. The arbitrator’s verdict is final and cannot be appealed.

Common chargeback reasons (+ how to prevent them)

Some90% of merchantssaid that “cardholder abuse of the chargeback process” was a major concern for their business. Let’s look at some common chargeback reasons and tips for preventing and responding to them.

Chargeback reasons

1. Fraudulent transactions

When someone receives a charge from your store but never buys anything, it could be a fraudulent transaction. Fraud, or “no authorization” chargebacks, account for56% of all chargebacks.

A new type of fraud known as “friendly fraud” has recently popped up. A customer buys something online with their credit card, then disputes the charge with their bank. It’s known as friendly fraud because the customer comes off as honest and innocent, but it should be called theft. By 2023, it’s estimated that61% of all chargebackswill be the result of friendly fraud.

How to prevent it

- Use a POS system that accepts secure payment methods likeEMVchip cards.

- Train staff on the best ways to accept in-person debit and credit card payments.

- Use Shopify POS to email receipts to customers.

How to respond

How you respond to fraudulent chargebacks hinges on the nature of your business and the circumstances of the transaction at hand. If you obtained authorization from the cardholder and used AVS and CVV, then you should supply at least the following in your response:

- Copy of the transaction invoice or signed order form

- Proof of delivery

If the cardholder collected merchandise from your physical storefront/location, include:

- Cardholder signature on the pick-up form

- Copy of identification presented by the cardholder

- Details of identification presented by the cardholder

If the merchandise was delivered to the cardholder’s address, include:

- Evidence of delivery date and time

- Proof that the item was delivered to the same address

If the merchandise was delivered to the cardholder’s business address, include:

- Evidence that the merchandise was delivered

- Proof that the cardholder was working at the address at the time of delivery

PRO TIP:Shopify Paymentscomes with Automatic Dispute Resolution, which can nearly double your win rate from unnecessary chargebacks.

2. Unrecognized business name

信用卡声明显示钱部siness the customer doesn’t know can prompt a chargeback request. For example, a customer may get confused and file a dispute if your business is Mike’s Dress Shoes but your company’s legal name is Michael’s Trading Co.

How to prevent it

- Have a clear and consistent company name on your receipts. You can change your receipt name in your Shopify admin.

How to respond

Treat unauthorized business name responses as you do chargebacks categorized as fraudulent. Suppose you obtained authorization from the cardholder and used AVS and CVV. In that case, you should supply the following:

- Copy of the transaction invoice or signed order form

- Proof of delivery (based on the method of delivery)

- A connection between the order recipient and the cardholder

- Proof that the cardholder disputing the transaction is using the merchandise

- Proof that the IP address, email address, physical address, and/or telephone number was used in a prior undisputed transaction

3. Shipping or delivery issues

Customers may also file a dispute if they never receive an item, or are overcharged for a product or service.

How to prevent it

- Require a signature upon receipt for all deliveries.

- Maintain accurate listing prices.

- Keep tracking numbers for all orders accessible.

How to respond

Winning these chargebacks requires evidence that proves the customer received the product, service, or digital goods before the date they disputed the transaction. But the evidence you provide all depends on what type of merchandise you provide to the customer.

If physical merchandise was shipped, include:

- Tracking number

- Complete shipping address information

- Date of shipment prior to the dispute date

- Shipping carrier

- Proof the address delivered to matched the address provided by the customer

If digital merchandise was provided, include:

- Proof the customer accessed the purchased digital goods

- IP address

- Timestamps

- Server or activity logs

If the transaction occurred digitally where an offline service was provided, include:

- Date of services

- Documentation showing the services were provided to the customer on the specified dates

4. Subscription billing

Collectingrecurring paymentsfrom customers is a risk for payment disputes. Many people forget about subscription renewals and will initiate a chargeback to cancel the payment.

How to prevent it

- Ensure customers understand the recurring transaction agreement (RTA) they sign up for.

- Include the billing frequency, amount, refund, and cancellation policies in your RTA.

- Let customers know you are about to bill them, so they can cancel ahead of them if they want.

How to respond

The contents of a subscription billing chargeback response depend on the unique circumstances of the transaction.

Sometimes, a customer may have contacted you to cancel the subscription. Still, due to the terms in your subscription cancellation policy, the cancellation would not go into effect until after the following billing cycle.

If the customer disputes this transaction, you need to provide:

- The subscription cancellation policy to which the customer agreed

- A description, usually a screenshot, of how the customer was shown your cancellation policy at the time of the transaction

In contrast, the situation could instead be one where the customer did not contact you to cancel their subscription. In this case, you need to supply documentation to prove that the subscription was not canceled and that you or your acquiring bank were not notified that the subscription billing was canceled.

This documentation usually includes one of the following as compelling evidence to disprove the chargeback:

- A notification sent to the customer renewal or continuation of subscription

- Proof that the customer continued to use the product after the claimed date of cancellation

If digital goods were provided:

- Proof that the customer accessed the purchased digital goods after the date of claimed cancellation, including:

- IP address

- Timestamps

- Server or activity logs

5. Credit not processed

Customers that expect a refund and store credit but don’t receive it can dispute the charge. This also applies to canceled transactions that still go through.

How to prevent it

- Have clear and easy-to-find return, refund, and cancellation policies.

- Set up a reliable system for returns and refunds.

- Return all funds to the same card used to make the original purchase.

How to respond

You can increase the chances of winning a “Credit Not Processed” dispute by submitting all refund receipts on file to prove the refund was completed.

6. Not happy with product or service

Customers may initiate a chargeback if the product arrived damaged, defective, or was not described accurately by the merchant. They can also dispute the charge if they believe the item is low quality or fake.

How to prevent it

- Make sure product descriptions are accurate and don’t overhype your products.

- Respond to customer service inquiries quickly and respectfully.

How to respond

In most cases of product issue-related chargebacks where the customer claims the merchandise was not as described, the following evidence will make the best case to prove the dispute to be invalid:

- A rebuttal addressing the cardholder’s claims

- Documentation (product description screenshots, copy, etc.) proving the merchandise delivered matched what was described

- Documentation to prove the cardholder did not attempt to return the merchandise (if applicable)

In addition to the compelling evidence above, additional documentation needs to be provided based on the method of delivery:

If physical merchandise was shipped, include:

- Tracking number

- Complete shipping address information

- Date of shipment prior to the dispute date

- Shipping carrier

- Proof the address delivered to matched the address provided by the customer

If digital merchandise was provided, include:

- Proof the customer accessed the purchased digital goods

- IP address

- Timestamps

- Server or activity logs

If transaction occurred digitally where an offline service was provided, include:

- Date of services

- Documentation showing the services were provided to the customer on the specified dates

What are your rights as a merchant?

There aren't many rights for merchants when it comes to chargebacks. No matter what your return policy is, consumers can file chargebacks under the Fair Credit Billing Act.

In payment disputes, banks often favor the cardholder over the merchant. Customers who are successful in filing and winning a dispute arenine timesas likely to initiate another one.

For this reason, you must document all debit and credit card transactions and adhere to the strict rules set by the card networks.

Common reason codes

Mastercard

Visa

American Express

Discover

How Shopify handles payment disputes

When you get a chargeback or inquiry on an order made with Shopify Payments, Shopify collects evidence and sends it to thecredit card processingcompany on the due date.

Before Shopify sends the response, you can add additional evidence in the Shopify admin. After the evidence is submitted, the chargeback or inquiry is resolved within 120 days.

Ready to create your business? Start your free trial of Shopify—no credit card required.

Credit card chargeback FAQ

How do chargebacks on credit cards work?

- A cardholder disputes an unauthorized charge with their service provider.

- The bank sends a chargeback request to the credit card company, and you are charged for the disputed amount and fee.

- When the credit card company asks for proof of a valid charge, you must provide it.

- To prove the validity of the charge, you gather evidence and add it to the chargeback response.

- You forward your chargeback response to the credit card company.

- After reviewing the evidence, the credit card company decides whether to approve it or not. It can take up to 75 days for the response to be reviewed.

What qualifies for a credit card chargeback?

- Fraudulent transactions

- Unrecognized business name

- Shipping or delivery issues

- Subscription billing

- Credit not processed

- Not happy with product or service