Raising capital for your next venture can be a major hurdle on the road to bringing your vision to life.

While bank loans and pitching to traditional investors are still viable fundraising options,crowdfundinggives you the opportunity to solicit support from the crowd: a group of individuals who collectively invest in your idea to make it a reality.

What’s more, crowdfunding can also give entrepreneurs a way to validate demand for their ideas, before they enter production, by letting others “buy into it” with pre-orders, donations, and investments.

什么是crowdfunding and how does it work?

Traditional fundraising relies on raising a large sum of money from one source at a time. Crowdfunding, on the other hand, is a strategy that focuses on raising smaller amounts of money from a larger collective of individuals.

These “backers”—as they’re often called—can be offered a number of incentives in exchange for their support:

- The opportunity to become early adopters of an innovative product

- The option to pre-order a product and have a say in its development

- Exclusive rewards like an early bird discount or free swag when you launch

- Personal access to the founding team or the chance to support people they know personally

- Equity in an early or growth stage company with high potential, though this is less common for consumer-facing brands

While every crowdfunding site has its own unique features, platform fee and overall fee structure, and user base, the core concept is the same—you submit your project to the platform with a fundraising goal and a deadline, and then campaign for support online, often through social media.

So, what are your options if you want to crowdfund your business? Let’s take a look at some of today’s best crowdfunding sites (and Kickstarter alternatives), spanning a variety of use cases, for you to raise funds for your next campaign.

8 best crowdfunding sites for new creative projects

- Kickstarter

- Indiegogo

- Patreon

- Crowdfunder (Shopify App)

- GoFundMe

- Fundable

- Crowdcube

- Crowdfunder

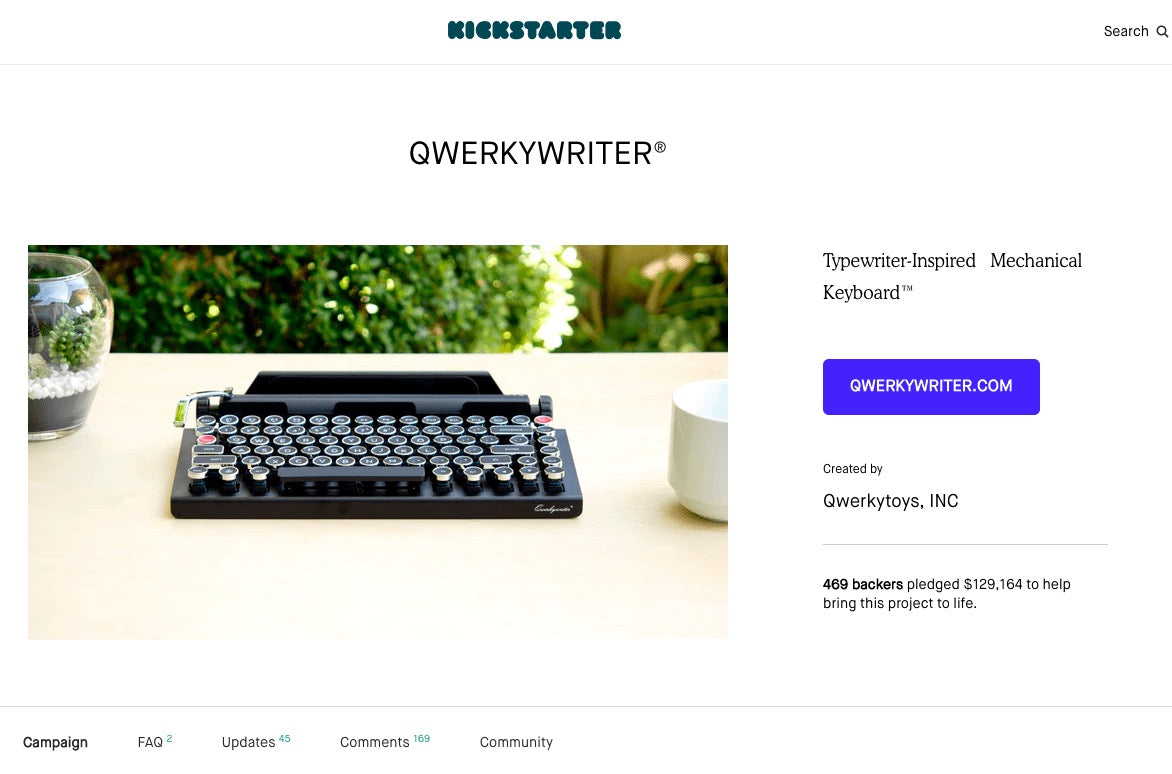

1. Kickstarter

Website:Kickstarter

Fees:5% if you meet your goal (not including payment processing fees)

Kickstarteris almost synonymous with “crowdfunding” as one of the most popular platforms where innovative ideas can find support. Since its launch in 2009, the Kickstarter community has successfully funded over 156,000 projects—including physical products, movies, games, and more—for a total of $4.1 billion raised.

Kickstarter is a reward-based crowdfunding platform. Backers are offered incentives to support the project, from t-shirts to shoutouts to exclusive pre-order discounts. You can offer different tiers of rewards too; the more money a backer pledges, the better the rewards they unlock.

Kickstarter campaigns are an all-or-nothing affair, which means that you only get access to your funds (and pay Kickstarter’s fees) if you meet your initial fundraising goal. If you fall short, then all the money remains with your backers.

The result is that projects on Kickstarter tend to be high quality and novel—often creative or innovative enough to catch the attention of early adopters and headlines from the press. Backers also generally view these projects as more trustworthy given they don’t actually part with their money unless the campaign succeeds.

You can learn more about running a successful Kickstarter campaign in our interview withRockwell Razors. And if you’re looking to transition from your Kickstarter campaign to a Shopify store, be sure tocheck out our guide.

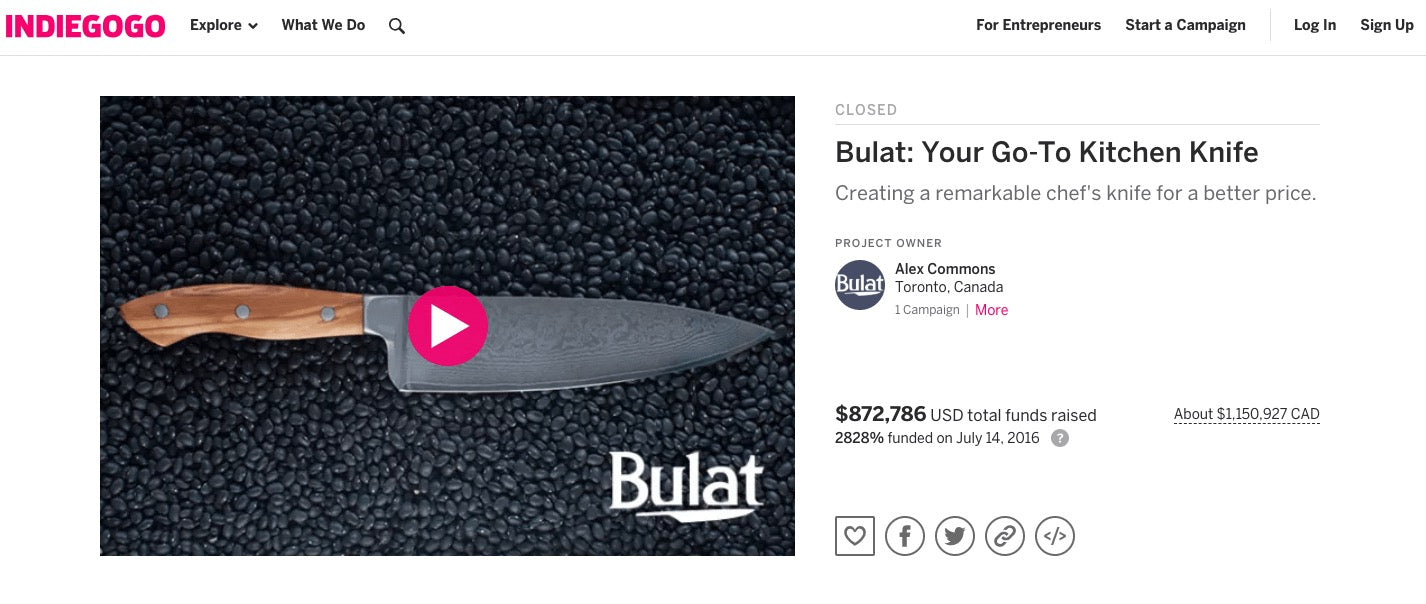

2. Indiegogo

Website:Indiegogo

Fees:5% if you meet your goal (not including payment processing fees)

Indiegogois a robust crowdfunding platform that supports businesses, artists, and nonprofits. While at first glance it may sound similar to Kickstarter, it comes with its own unique features and campaign options.

The most noteworthy difference is the option to choose a fixed funding goal (all-or-nothing like Kickstarter) or a flexible funding goal for your campaign. With flexible funding goals, you receive your funds regardless of whether you’ve met your goal by its deadline.

The flexible funding option is especially useful when you can fulfill your promise to backers even if you don’t raise enough capital, say if you’re launching a new product line for an established business.

On top of that,Indiegogo InDemandlets you continue raising money even after your crowdfunding campaign ends, while you’re in the production stage or getting ready to fulfill orders. InDemand is available to you whether you run your campaign on Indiegogo or another crowdfunding platform.BodyBoss实际上转换到Indiegogo InDemand正确after their success on Kickstarter.

Startups based in the U.S. might also considerIndiegogo’s equity crowdfundingoffering—where you can submit your campaign for consideration to investors on the platform looking for a financial stake in your company.

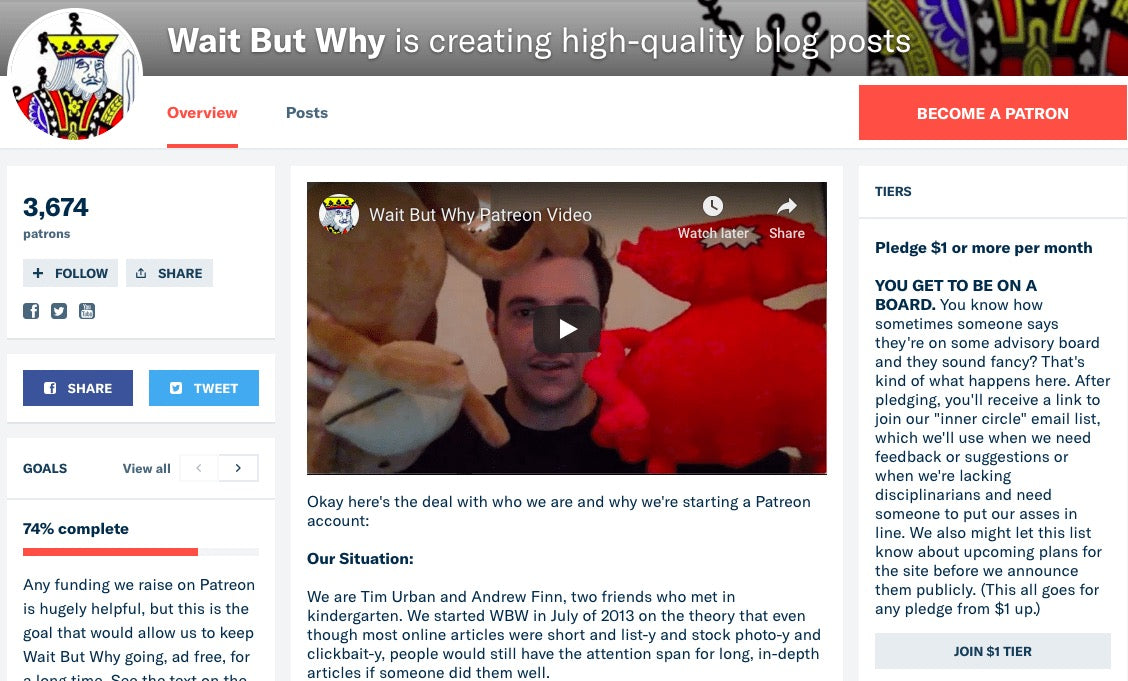

3. Patreon

Fees:5% (not including payment processing fees)

Patreonis one of the most unique platforms on this list with a specific focus on the new wave of creators—bloggers, YouTubers, podcasts, cartoonists, musicians, live streamers, and their ilk.

Whereas many of the top crowdfunding sites support limited-run campaigns, Patreon was made for creators and internet personalities with loyal audiences to generate recurring revenue through paid memberships. You can choose to let patrons pay “per month” for special community perks, or pay “per Creation” to incentivize you to create more.

Patreon creators offer all kinds of exclusive perks based on different payment tiers, such as exclusive content, branded swag, sneak peeks, shoutouts, and more. If you’re a creator who regularly ships new content and has a sizable online fan base, it might be worth creating a Patreon page.

Here, you can build a community of dedicated fans and serve exclusive content (through Patreon’svarious integrations) that unlocks based on the patron’s membership tier.

You can learn more about monetizing your audience with Patreon in this interview withWait But Why.

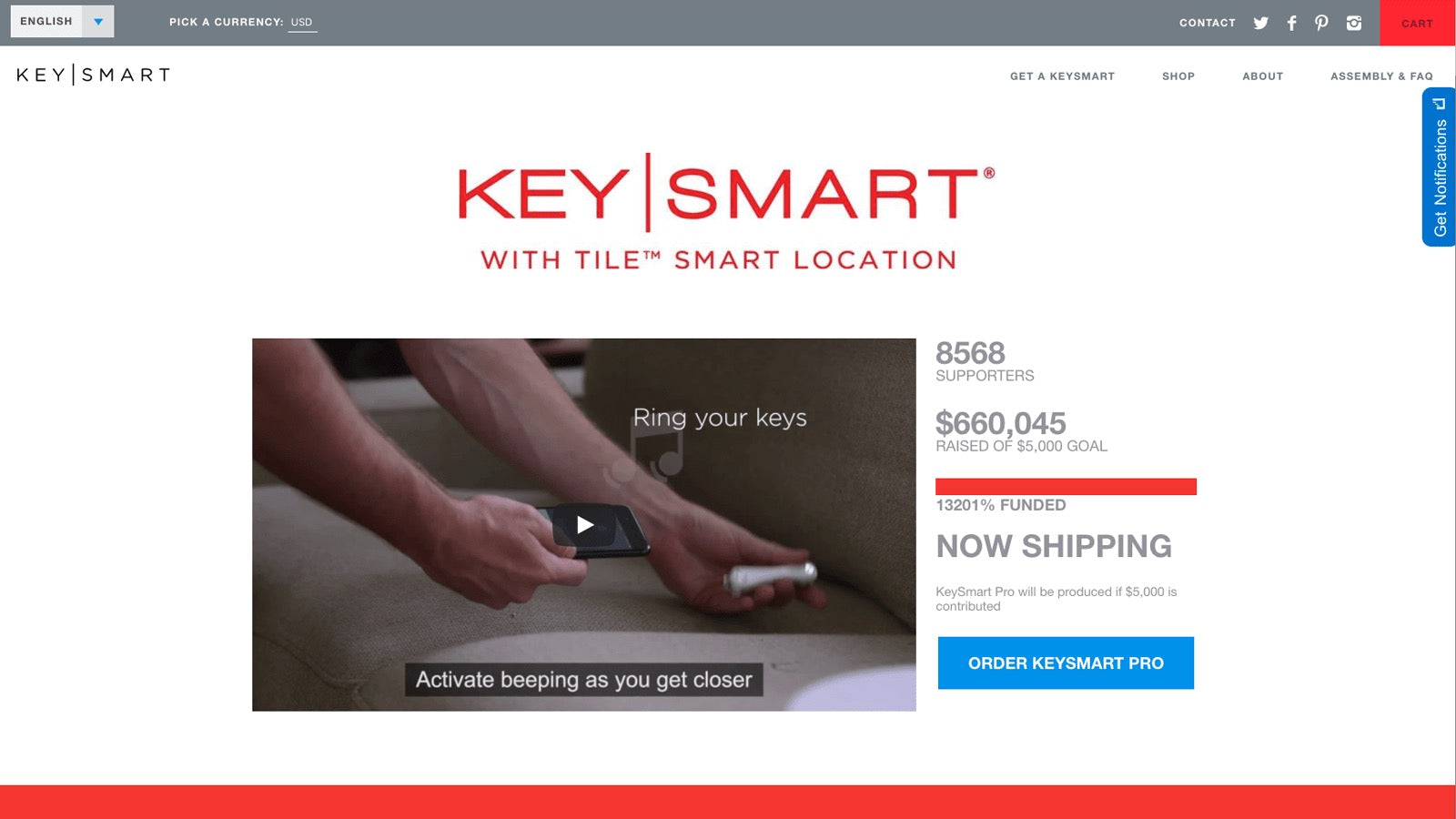

4. Crowdfunder (Shopify app)

Fees:$29/month (not including your Shopify subscription)

If you already have a Shopify store and are interested in crowdfunding a new product through your own website, theCrowdfunder appfor Shopify is a great fit.

With this app, you can transform your product page into a crowdfunding page, complete with a progress bar, setting your goal based on a threshold of items ordered or money raised.

It enables crowdfunding in its simplest form: accepting pre-orders from people as a way to simultaneously validate an idea and fund production. Plus, you can avoid the commissions charged by third-party platforms in favor of a more predictable monthly fee.

You can use it to test out new product ideas, raise money for a cause, or launch limited-run products.

5. GoFundMe

Fees: Free (not including processing fees)

GoFundMeis a free crowdfunding platform built primarily for supporting individuals and causes.

Because GoFundMe is suited to personal causes—and anyone can go about creating a campaign—backers on here tend to only support campaigns that come from within their own personal networks and communities or causes they’re familiar with.

为商业crowdfundin GoFundMe不是设计g campaigns, like the other platforms on this list. However, if you’re a small business owner who has fallen on hard times, or you need to raise money to overcome a personal challenge, you can try leveraging this platform for support from your personal network.

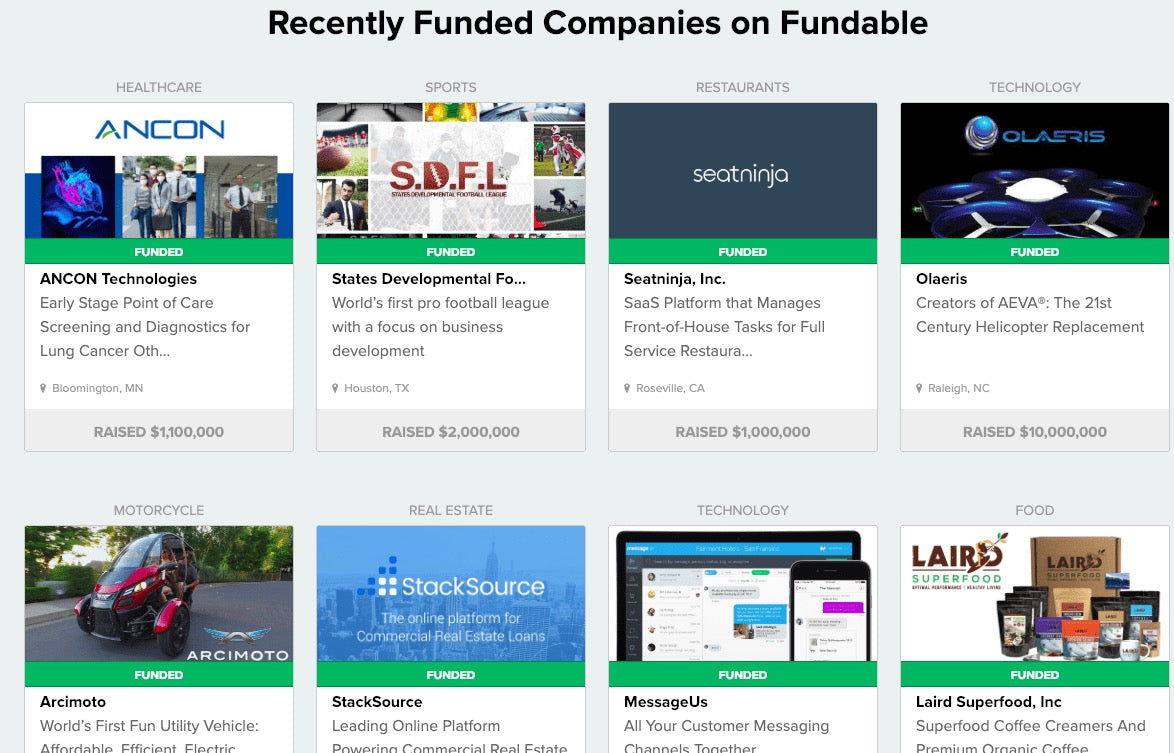

6. Fundable

Fees:$179 per month during active campaigns instead of a percentage of total funds raised (not including payment processing fees).

Fundableis part of the Startups.co platform and is among the top crowdfunding sites that allow startups (registered in the U.S. only for now) to offer rewards or equity in exchange for funding.

According to their site, startups that offer rewards typically raise less overall (under $50,000) but get more backers, whereas startups that offer equity usually raise more capital from fewer investors.

However, to succeed with equity fundraising you need all the ingredients accredited investors expect to see: a track record of growth, a solid business plan, and a pitch deck, if not more.

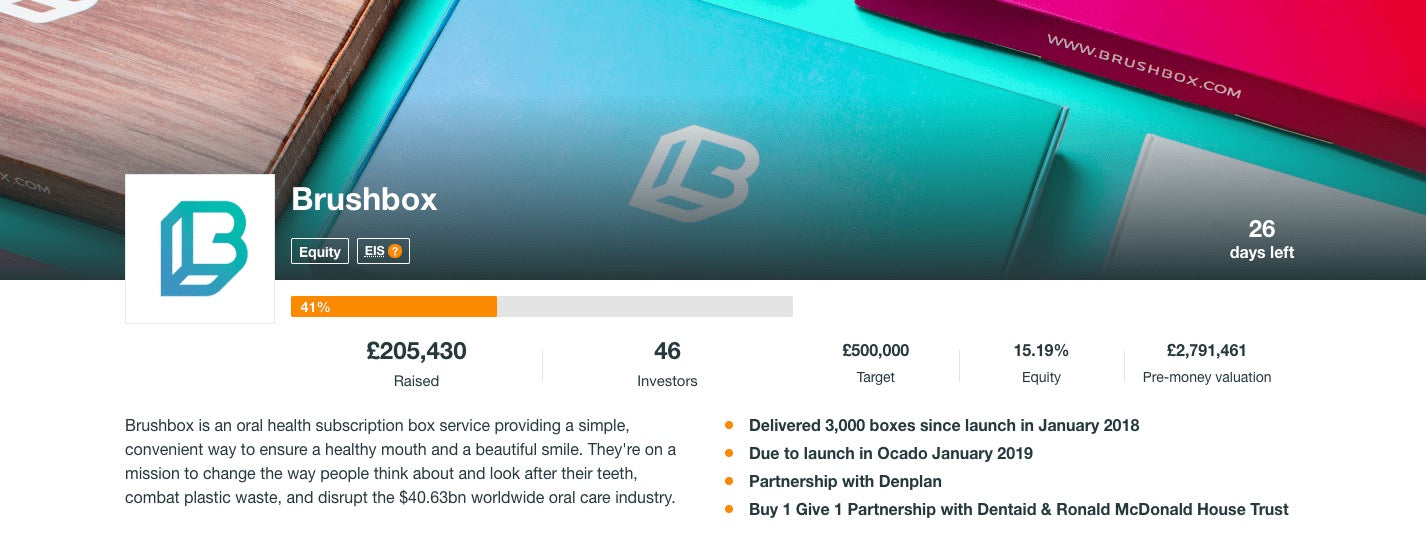

7. Crowdcube

Fees:7% of funds raised if you meet your goal and a 0.75% to 1.25% completion fee.

Crowdcubeis a UK-based equity crowdfunding platform. It has a relatively small number of campaigns, but companies that are approved and succeed with their fundraising goals on the platform are able to join Crowdcube’s “Funded Club”, gaining exclusive benefits from their partner organizations.

You can promote your pitch to solicit investors from your network or appeal to Crowdcube’s established community of investors.

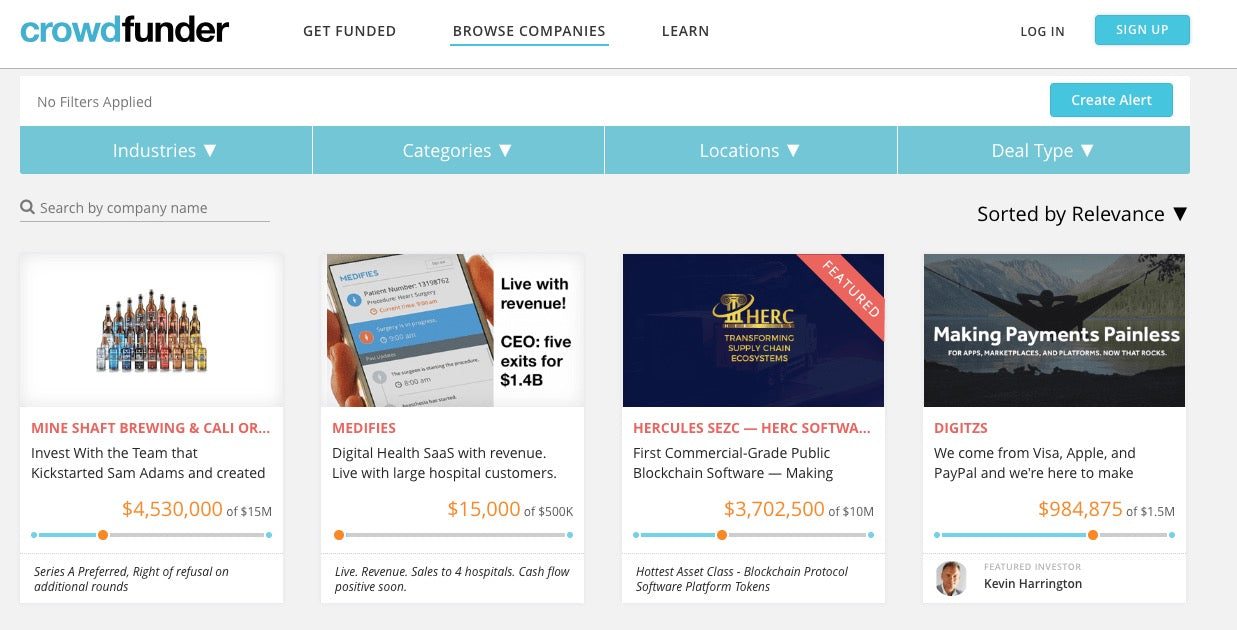

8. Crowdfunder

Fees:Plans start at $299 per month to create a public profile and “deal room” to invite investors. You can create a non-public profile and deal room for free.

Crowdfunderis another equity crowdfunding platform where you can raise capital through a "crowd" of accredited investors. Its network includes over 12,000 venture capitalists and angel investors for you to potentially connect with and pitch.

Rather than paying a percentage fee on the funds you raise, Crowdfunder offers monthly plans. As such, the platform is ideal for startups that have already experienced some degree of validation and have demonstrated their potential for growth. Deals can be made for equity, debt, convertible note, or revenue share.

Choosing a crowdfunding site is just the beginning

Crowdfunding can offer entrepreneurs a way to validate their product ideas, raise the money needed to start production, or fund their growth with access to a network of potential investors and customers.

In fact, many Shopify merchants were able to take off thanks to the money they raised through crowdfunding sites like the ones above.

But it still takes a little bit of luck and a lot of preparation for you to realize your fundraising goals. You need to convince people that your idea is worth backing, after all, pitch your campaign the right way to the right people.

If you’re interested in crowdfunding, be sure to also check out the following case studies and interviews from successfully crowdfunded businesses: